As an entrepreneur, have you ever hit a “growth wall”? No, not the cement kind, but what feels like an enormous barrier preventing your business from growing at the rate it was previously experiencing? It’s puzzling, as the strategies that once worked to accelerate your business and solve your growth obstacles are no longer effective.

You feel stuck, overwhelmed, and frustrated. To understand how to conquer these growth obstacles, we need to dive into what your constraints are and how to navigate through them.

Growth Walls Are Business Constraints

These growth walls are the result of different constraints a business experiences throughout a business life cycle. A business constraint is a force that every business must face in order to grow and execute a strategy to achieve its business and revenue goals. Let’s first explore what a business life cycle is, and then unpack the different constraints it can expect to experience.

What is a Business Life Cycle?

A business life cycle is the progression of a business in phases over time. Visually, your business begins as a start-up phase, then moves into a growth phase, typically your business matures, ( maybe you exit, and then your business declines.

This is very similar to the economy where there are natural expansion, peaks, and contraction phases.

When your business begins to scale and hit new revenue milestones, it will have new constraints. To ensure your business can grow past these plateaus, we need to solve the constraints for each business growth cycle. Let’s explore what a growth cycle is and how they work.

What is a Growth Cycle?

A growth cycle is a commitment to work on either maximizing profit OR maximizing growth in your business over a fixed period of time.

Profit requires efficiently using fewer resources to maximize your bottom line, while growth requires investing more resources to maximize your top-line revenue. However, profit and growth are like oil and water. They are always in direct conflict with each other. If you try to maximize both at the same time, you’ll end up accomplishing neither!

What Major Constraints Do We Solve When Scaling Our Business?

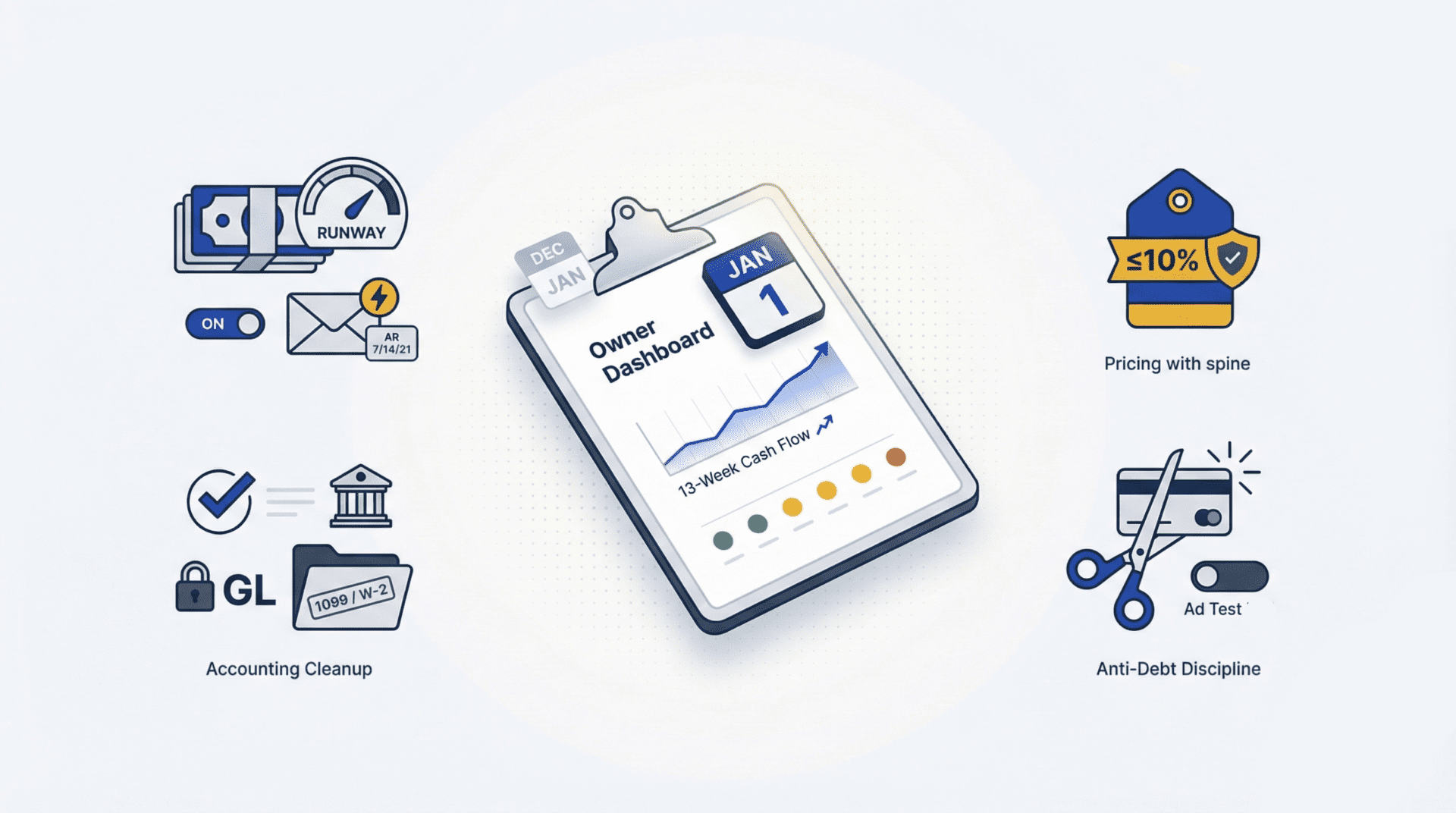

The graphic below illustrates the constraints we’ve seen with our clients:

Interpreting The Major Business Constraints Diagram

At the bottom of the graph, you will see a constant constraint: the continual development of your product or service offering. Every business needs to continually improve its product and service offering, and therefore it is a perpetual constraint. Think of this as an R&D expense. While you are always developing your offer, your product/service will always be a constraint in the business. It is not categorized as a significant constraint – because we need to assume we are constantly working on it.

Every year, Apple comes out with a new iPhone model. The iPhone 13 today looks nothing like the original iPhone that debuted in 2006. This is the continual development of their core product that took billions of dollars and years of R&D in order to remain competitive in the market.

Looking at the graph, we also see three significant constraints when scaling an online business from $0 – $250k per month.

Business Constraints When Scaling From $0 – $75,000 per month

During the start-up phase of our business, your greatest constraint will always be Client Acquisition (“CA”). CA is the ability to get people to buy your product or service and you need to spend to do this. So this equals the sum total of your marketing and sales cost.

Once suitable systems are in place here, whether you’ve brought on the right team (with well-thought-out incentive structures), or whether you’ve built a paid or organic marketing program, you’ll experience top-line revenue growth. You can then expect to hit the next growth wall, and that is our cue to start solving the next significant constraint.

Business Constraints When Scaling From $75,000 – $150,000 per month

The next constraint you need to solve will be running your business operations efficiently. These constraints are limitations in your internal operations – Fulfillment, HR (hiring), Finance. In this phase, operational systems are predominantly the biggest failure. Your business may not be well-equipped enough for the increase in customers from improving your Client Acquisition systems. It might not have the right back-end systems in place for delivering your product or service, or the talent acquisition machine to fill the gaps in your business. You may need to spend to build operational efficiency so you can service your newly-found clients.

Business Constraints When Scaling from $150,000 – $250,000 per month

In this phase, your business is flying. Without a doubt, when scaling from $150,000 and beyond, the biggest constraint you will experience is your leadership.

Before $150,000/month, you can be both a leader and manager in your company. After that, your time becomes critically valuable and in order to move your business forward, you must hire the right managers to take care of the different business functions and grace your company with the vision, direction, and leadership.

It’s at this point the CEOs should surround themselves with the right people to take the business forward. Have you hired the right team players? Have you built your executive team? It’s essential to be surrounded by the right people and to have a tight leadership team removing your blindspots to challenge you in your decision-making. Making decisions on your own at this stage of your business will not propel it forward.

Will My Business Ever Reach a Point of No Constraints?

Once we have gone through this cycle of constraints, we keep going through the iterative process – building and solving the new constraints your business encounters. Identifying and solving your business constraints will help you scale your business at any level. Building the right financial foundation is necessary to scale predictably, efficiently, and sustainably.

Our encouragement is to understand these foundations, solve them properly, and you will succeed.

About CleverProfits

We know that running a business is hard, but the good news is that it’s totally possible to reduce the business noise and lead with confidence and focus. To do this, and enable confident decision-making, it’s important to have financial clarity.

At CleverProfits, we help optimize business performance, enabling long-term financial clarity giving your business and your decision-making the kick-start it needs for sustainable and predictable growth. If you’re stuck, feeling anxious, and need help – reach out.

Book a free call with us here: https://cleverprofits.com/consultation/

The Clever Writing Team

The CleverProfits writing team includes various team members in Advisory, Financial Strategy, Tax, and Leadership. Our goal is to provide relevant and easy-to-understand financial content to help founders and business leaders reach their true potential.