Quick Answer – for Busy Humans

Why hire a Fractional CFO? Because you get enterprise‑grade financial leadership – cash flow control, pricing strategy, forecasting, board‑ready reporting, and tax efficiency – at a fraction of a full‑time cost. A Fractional CFO helps you grow, protect margin, and scale with discipline while your accounting team keeps the books accurate. CleverProfits provides a unified stack: strategic CFO guidance + airtight accounting + proactive tax planning so your decisions are data‑driven, timely, and tax‑smart.

What founders are asking right now

Here are the most‑searched, most‑debated questions around Fractional CFO services in 2025—and real answers:

- “Why hire a Fractional CFO instead of a full‑time CFO?”

Because you get senior‑level strategy without a $250K+ salary + bonus + equity. A fractional model scales with need: start at a few hours per week, expand during financing, M&A, or rapid growth. - “What problems does a Fractional CFO actually solve?”

Chronic cash crunches, unclear unit economics, inconsistent margins, messy budgets, late financials, pricing drift, and tax surprises. The fix is a repeatable operating cadence: forecast → review → act. - “When is the right time to hire?”

You’ve hit product‑market fit, crossed $1–$3M ARR/revenue, margins are wobbling, or you’re prepping for debt, equity, or an exit. If your decisions feel like guesswork, you’re past due. - “How much does it cost?”

Typical models: monthly retainer or hourly blocks. Many growth‑stage businesses invest $4K–$12K/month for a seasoned Fractional CFO (scope‑dependent), versus $20K+/month fully loaded for a full‑time executive. We outline budgeting below. - “What’s the difference between a Fractional CFO, Controller, and CPA?”

Controller = accuracy and controls. CPA/tax = compliance and tax strategy. Fractional CFO = forward‑looking strategy, capital planning, pricing, and performance.

Why a Fractional CFO beats “wait and see”

“Wait until we’re bigger” is a costly default. Here’s why “Why now?” is the right question:

- Compounding decisions: Pricing, packaging, and headcount choices compound monthly. A fractional CFO ensures each turn of the wheel builds value instead of burn.

- Capital efficiency: Better cash conversion cycles (CCC) and working capital discipline let you do more with less—especially crucial before you raise or when rates tighten.

- Board‑ready rigor: Predictable reporting cadence turns investor updates into strategic conversations, not apologetic explanations.

- Tax alpha: Early structures (LLC/S‑Corp/C‑Corp), R&D credits, and entity optimization have multi‑year impact. Get them right before growth locks in the wrong foundation.

Bottom line: The faster you adopt CFO‑level discipline, the faster you convert growth into durable profit without over‑hiring overhead.

ROI: Where the value actually shows up

A great Fractional CFO changes outcomes you can measure. Expect impact in these lanes:

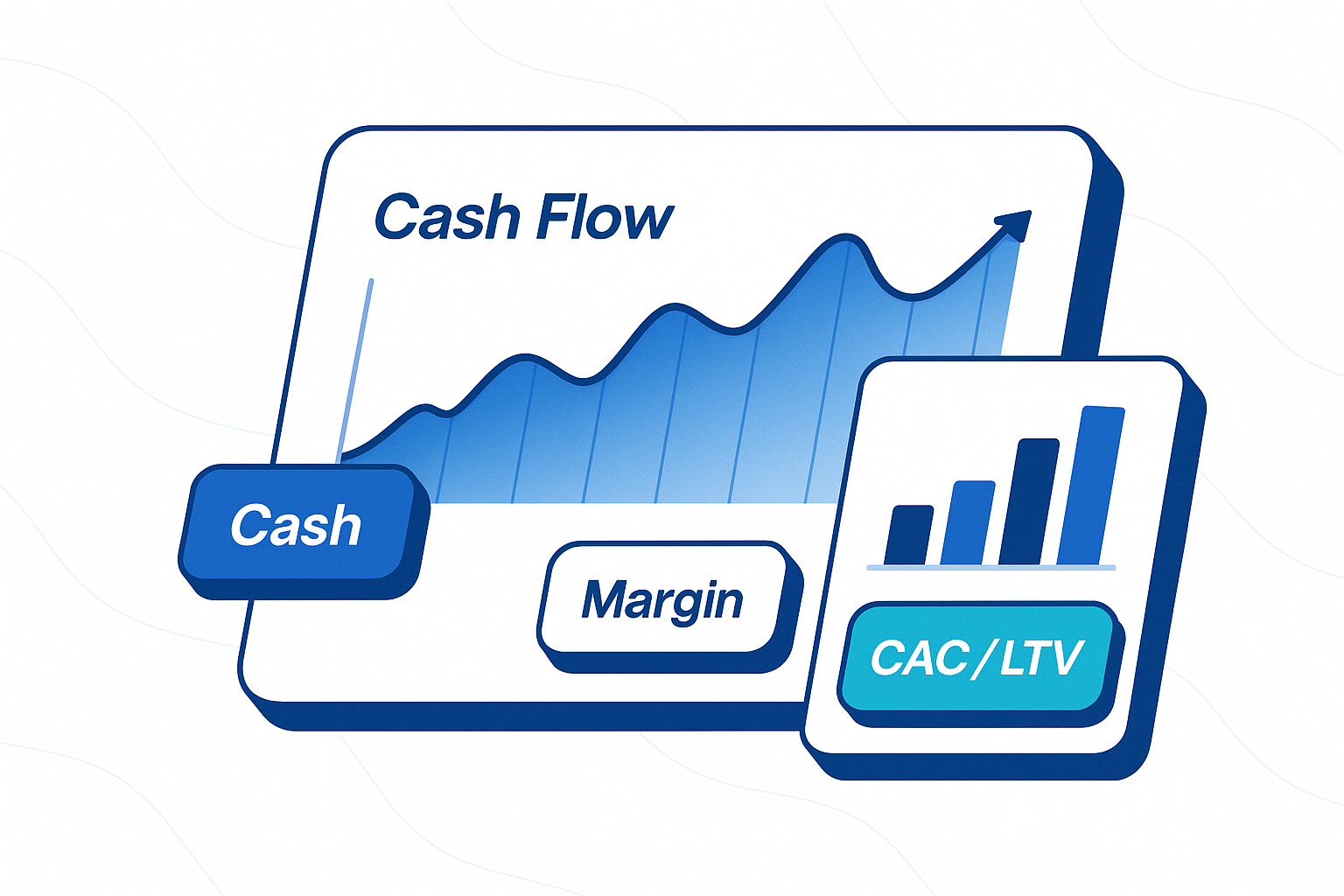

1) Cash & runway

- 13‑week cash flow installed

- Vendor terms renegotiated

- DSO/DPO tuned for liquidity

- Collections playbook → fewer write‑offs

2) Margin & pricing

- True unit economics by product/channel

- Price architecture and discount guardrails

- COGS/margin leakage audits → 2–8 pts reclaimed

3) Operating clarity

- Rolling 12‑ to 24‑month financial model

- Budget vs. Actual variance with owner actions

- KPI tree (north‑star + leading indicators)

4) Capital strategy

- Debt capacity assessed, term sheets compared

- Investor‑ready data room + narrative

- Covenant monitoring built‑in

5) Tax efficiency

- Entity structure aligned to growth path

- Yr‑round tax planning calendar

- Credits/deductions mapped to roadmap (R&D, 179, etc.)

What a Fractional CFO actually does (vs Controller vs CPA)

Fractional CFO (strategic):

- Build/own the model, forecast, and plan

- Design KPIs, pricing, scenario analysis

- Facilitate monthly exec finance meeting

- Lead capital strategy, M&A, board reporting

- Translate finance → go‑to‑market and ops

Controller (operational accuracy):

- Close the books on time

- Maintain controls, reconciliations, revenue recognition

- Manage AR/AP, payroll, audits

- Partner with CFO for variance insights

CPA/Tax (compliance & planning):

- File federal/state returns

- Optimize multi‑state/nexus positions

- Plan quarterly estimates, credits, elections

How CleverProfits covers all three: Our Fractional CFOs run strategy, our Accounting team ensures a clean close, and our Tax team turns savings into cash flow. One integrated cadence, no finger‑pointing.

When to hire: clear thresholds and triggers

Revenue thresholds

- $1–3M: Cash is lumpy; implement 13‑week cash flow and budget discipline.

- $3–10M: Growth exposes unit‑economics gaps; formalize pricing, sales comp, and margin accountability.

- $10–50M: Board/investor pressure; scenario planning, debt facilities, and data room readiness.

Event triggers

- Fundraise, acquisition talks, or bank debt

- New product line or channel expansion

- Multi‑state hiring/tax exposure

- Missed forecasts, rising churn, or margin slide

- Key customer concentration risk >25% revenue

If two or more triggers are true, you’ll get near‑term ROI from a Fractional CFO.

Cost: models, benchmarks, and how to budget

Pricing models you’ll see

- Monthly retainer: Most common; fixed scope with quarterly refresh.

- Hourly blocks: Flexible, better for projects or very early stage.

- Milestone‑based: For fundraise/M&A, with success fees.

Budget guidelines (typical for growth‑stage firms)

- $4K–$12K/month for ongoing Fractional CFO leadership—scope and complexity drive range.

- $150–$350/hour for project‑based or early‑stage support.

- Net of savings, many clients see 2–5x ROI from price resets, vendor terms, tax planning, and reduced hiring risk.

Compare to full‑time: A seasoned full‑time CFO often exceeds $250K+ all‑in (salary, bonus, payroll tax, benefits), plus equity. Fractional keeps fixed costs light while giving you true C‑suite leverage.

How CleverProfits works with you

We plug in as a single finance partner with strategic CFO + daily accounting + proactive tax, to turn your numbers into decisions.

Step 1: Diagnose

- Deep‑dive into revenue engine, margins, and cash

- Quality‑of‑earnings style review on your books

- Tax posture & entity structure assessment

Step 2: Design

- Operating Model: 18 – 24‑month forecast with scenarios

- KPI Tree: 5 to 7 needles that matter

- Reporting rhythm: Monthly close + exec finance review

- Tax Roadmap: credits, elections, estimates

Step 3: Drive

- Weekly cash brief + near‑term actions

- Quarterly “Plan ↔ Actuals” reset

- Board/investor materials and fundraising prep

- Pricing tests, sales comp alignment, and cohort retention views

Tooling we love: QuickBooks, G‑Sheets and a clear data room.

Day‑one deliverables and 90‑day playbook

Day 0–14 (Stabilize)

- 13‑week cash flow + collections plan

- Close schedule, ownership, and SLAs

- Tax risk map: nexus, estimates, elections

Day 15–45 (Instrument)

- KPI tree & dashboard

- Unit economics by product/channel

- Budget v. Actuals with owners

Day 46–90 (Accelerate)

- Pricing & margin experiments

- Debt capacity & banking relationships

- Board‑ready narrative and data room

- Tax planning sprints (credits, fixed asset strategy)

By Day 90: You have an operating model that the exec team trusts and a cadence that keeps everyone accountable.

FAQ’s

Q1) Is a Fractional CFO only for startups?

No. Any business hitting complexity, multi‑state, multi‑product, or investor scrutiny will benefit. Many $10M–$50M companies choose fractional to stay lean.

Q2) Will a Fractional CFO replace my controller or bookkeeper?

No. We complement them. The CFO sets strategy; the controller/bookkeeper keeps the financial engine clean and timely.

Q3) How many hours per month will I get?

Typical ranges: 10 – 40 hours/month depending on scope. During events (raise/M&A), hours can spike then taper.

Q4) Can a Fractional CFO help with fundraising?

Yes, model credibility, data room assembly, KPI story, banker/investor prep, and diligence support.

Q5) How fast will we see results?

Cash clarity and reporting cadence improve in weeks; pricing/margin and capital strategy gains compound over 1–3 quarters.

Q6) What industries do you support?

SaaS, agencies, eCom/DTC, professional services, creator/education, and light manufacturing and any model where LTV, CAC, and margin matter.

Q7) Do Fractional CFOs handle taxes?

Many don’t. CleverProfits does with planning and filing. That’s where a lot of real cash savings live.

Q8) What does onboarding look like?

Kickoff, data intake, tool access, preliminary model, and a 30‑day alignment workshop. You’ll feel the cadence from Month 1.

Metrics that improve within 1–3 quarters

- Operating margin: +2–8 pts via pricing and cost discipline

- Cash conversion cycle: -10–30 days through terms and collections

- Forecast accuracy: <10% variance by Q3

- On‑time close: <10 business days monthly

- Tax savings: measurable reductions via entity, credits, and timing

- Valuation readiness: investor‑grade model and reporting on demand

SEO Resources: Glossary & Hiring Checklist

Mini‑Glossary (plain English)

- 13‑week cash flow: A rolling weekly cash map so you don’t get surprised.

- Unit economics: Profit per customer/product after all direct costs.

- CAC/LTV: Cost to acquire a customer vs. their lifetime value.

- DSO/DPO/CCC: Days Sales/Payables Outstanding / Cash Conversion Cycle.

- Variance analysis: Why actual results missed or beat plan—and what to do next.

Hiring Checklist

- □ Clear success metrics (cash, margin, forecast accuracy)

- □ Scope and cadence documented

- □ Pricing model that fits stage (retainer vs project)

- □ Controller & tax integration plan

- □ 90‑day deliverables and owner assignments

How CleverProfits helps you grow and scale

Fractional CFO Services

Strategic operating model, KPI design, board‑ready reporting, capital strategy, pricing, and scenario planning. We lead the finance conversation across sales, ops, and product.

Accounting & Bookkeeping

Close the books fast and clean. AR/AP, reconciliations, revenue recognition, payroll coordination, and audit readiness—all tied to your CFO cadence.

Tax Planning & Filing

Entity structure, quarterly estimates, multi‑state, and credits. We turn tax planning into runway and margin.

What this looks like working together

- One lead Fractional CFO, backed by a controller/bookkeeping pod and a dedicated tax manager.

- A monthly exec finance meeting with decisions, owners, and due dates.

- Quarterly strategic resets so your plan stays real.

Result: Financial clarity → confident decisions → durable profit.

Ready to move? Book a discovery call

If you’re reading this, you likely feel the gap between effort and outcome. A Fractional CFO closes that gap with clarity, cadence, and accountability—and CleverProfits brings the accounting and tax muscle to make it real.

👉 Book a call with a CleverProfits CFO to map your 90‑day plan and see where cash, margin, and tax savings are hiding. We’ll show you the numbers before you commit.

The Clever Writing Team

The CleverProfits writing team includes various team members in Advisory, Financial Strategy, Tax, and Leadership. Our goal is to provide relevant and easy-to-understand financial content to help founders and business leaders reach their true potential.

TABLE OF CONTENTS

- 13‑week cash flow, board‑ready reporting, capital strategy, cash conversion cycle, forecast accuracy, fractional CFO, fractional CFO cost, fractional CFO ROI, fractional CFO services, fractional CFO vs controller, hire a fractional CFO, pricing strategy, Tax Planning, unit economics, when to hire a fractional CFO