TLDR:

A fractional CFO gives you enterprise‑grade financial strategy, pricing, forecasting, cash discipline, and board‑ready reporting – without the full‑time price tag. It works in any industry because the CFO playbook maps to your revenue engine, unit economics, and cash cycle. CleverProfits wraps this with airtight accounting and proactive tax planning & filing so you get one integrated finance stack—and measurable, repeatable profit.

Why this guide (and how we picked the industries)

To ground this in the real economy, we looked at where most U.S. small businesses operate by establishments and employment using the latest Census County Business Patterns and the SBA’s 2025 Small Business Profiles. That gives us a practical Top‑10 cross‑section of SME activity. Then we show how a fractional CFO improves cash flow, margins, and tax outcomes for each sector.

The Top 10 SME Industries (broad NAICS sectors)

- Professional, Scientific & Technical Services (agencies, design, consulting, legal, accounting)

- Construction (specialty trades, GC)

- Retail Trade (omnichannel, specialty)

- Health Care & Social Assistance (including clinics, med spas)

- Accommodation & Food Services (restaurants, hospitality)

- Administrative & Support / Waste Remediation (staffing, facilities, services)

- Real Estate & Rental & Leasing (property managers, equipment rental)

- Other Services (except Public Admin) (repair, personal services)

- Transportation & Warehousing (last‑mile, logistics)

- Manufacturing (light manufacturing, DTC brands with ops)

These sectors account for the lion’s share of small‑employer establishments in the U.S. Their economics differ, but the CFO levers—pricing, mix, utilization, working capital, capex discipline, tax posture—are universal.

What a Fractional CFO actually delivers (works in any industry)

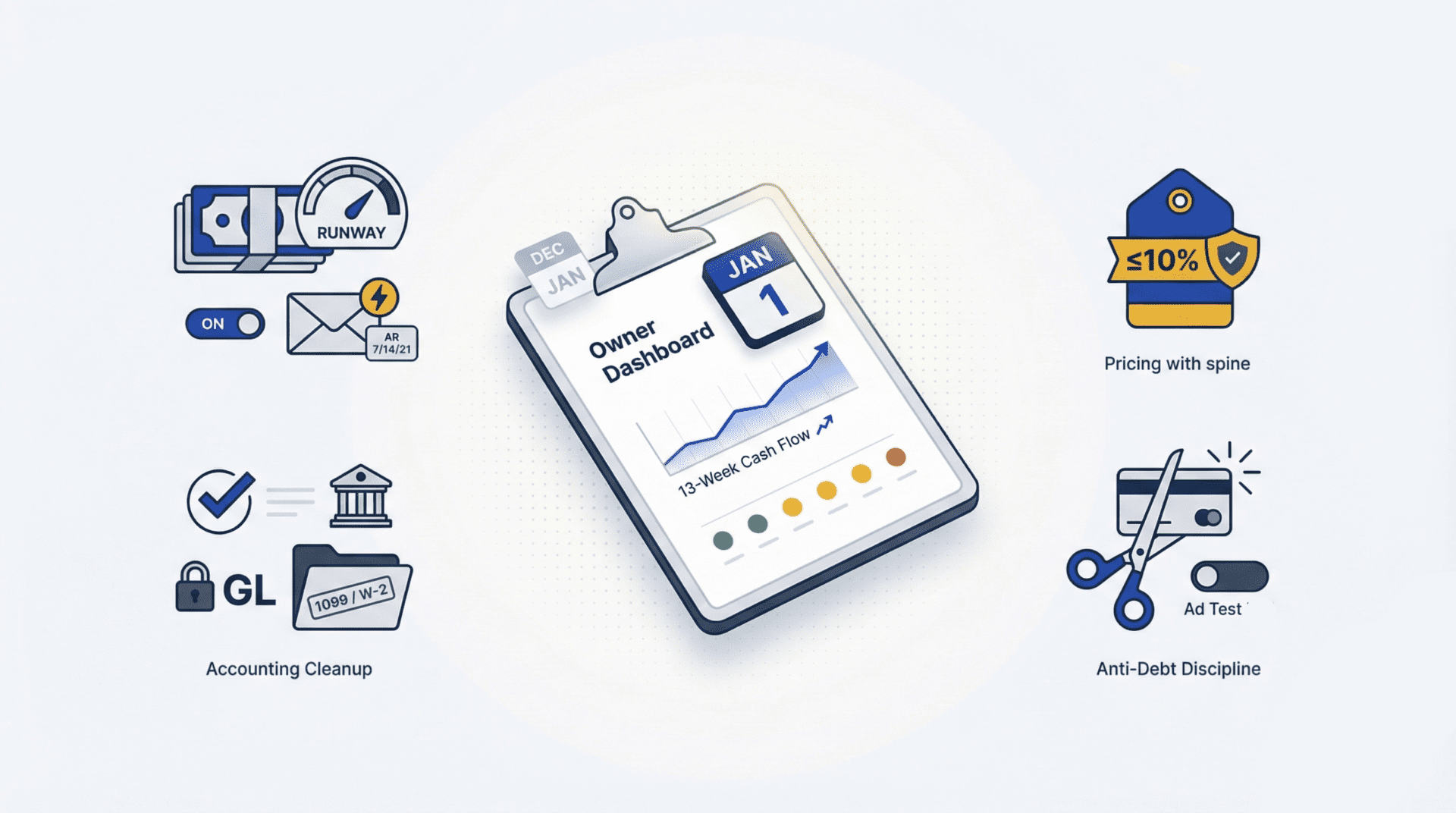

- Forecast & Model: 18–24‑month plan with scenarios and hiring/capex triggers.

- Cash Discipline: 13‑week cash flow, collections, vendor terms, DSO/DPO/CCC tuning.

- Pricing & Margin: SKU/service‑level unit economics, price/discount guardrails.

- Operating Rhythm: Monthly close, KPI dashboard, variance → action.

- Capital Strategy: Banking relationships, debt capacity, covenant monitoring.

- Tax Strategy: Entity choice, credits/deductions, multi‑state, quarterly estimates.

- Compliance Backbone: On‑time accounting & bookkeeping + controller‑grade controls.

Sector Playbooks: How CleverProfits plugs in

Below, we translate the CFO, accounting, and tax stack into sector‑specific moves. Keywords you may be searching: fractional CFO services, outsourced CFO, small business CFO, cash flow forecasting, financial modeling, accounting and bookkeeping, tax planning, tax filing, CFO strategy.

1) Professional, Scientific & Technical Services (agencies, creative, legal, consulting)

Pain points: scope creep, uneven utilization, pricing drift, slow collections.

CFO moves: billable utilization targets (≥75%), blended rate ≥2.5× loaded cost, retainer tiers, change‑order rules, AR automation, pipeline‑to‑capacity model.

Accounting: project‑level P&L, WIP tracking, revenue recognition.

Tax: entity optimization (S‑Corp vs C‑Corp), R&D credit for eligible software/process work, state nexus review.

Win you’ll feel: steadier CM%, quicker cash conversion, fewer write‑offs.

Explore: Fractional CFO • Accounting & Bookkeeping • Tax Planning

2) Construction (specialty trades, GC)

Pain points: job costing gaps, change‑order leakage, retainage, lumpy cash.

CFO moves: project cash curves, bonding/capacity planning, progress billing cadence, subcontractor controls, materials hedging rules.

Accounting: %‑of‑completion/contract revenue recognition, retainage receivable/payable, cost codes.

Tax: 263A/UNICAP where applicable, Section 179/bonus on equipment, state/local licenses and sales/use tax nuances.

Win: tighter job margins, reduced cash squeeze between draws.

3) Retail Trade (omnichannel)

Pain points: inventory carrying costs, shrink, promo‑driven margin erosion, seasonality.

CFO moves: open‑to‑buy plan, SKU velocity and price architecture, promo ROI guardrails, store/DC labor modeling, omnichannel attribution.

Accounting: perpetual inventory integrity, landed cost, shrink accounting, gift card liability.

Tax: sales tax compliance (multi‑state marketplace rules), inventory methods (FIFO/weighted average), credits for energy/fixtures in some cases.

Win: cleaner gross margin and lower dead stock, predictable holiday cash plan.

4) Health Care & Social Assistance (including Med Spas)

Pain points: device financing, provider scheduling, no‑show leakage, consumable waste.

CFO moves: room‑hour pricing, provider utilization targets (≥75%), prepaid packages/memberships, deposit policies, device ROI before purchase.

Accounting: separate consumables vs provider labor, prepaid liabilities, treatment‑line P&L.

Tax: entity and reasonable‑comp planning, 179/bonus for equipment, sales/use nuances by state.

Win: 2–6 pts margin reclaimed, positive working capital via prepaids.

Dive deeper: Fractional CFO • Tax Planning

5) Accommodation & Food Services

Pain points: thin margins, labor variability, food cost volatility, turnover.

CFO moves: menu engineering, labor scheduling to demand curves, vendor terms, waste tracking, location scorecard, delivery economics.

Accounting: weekly P&L cadence, inventory counts, tip credit handling, gift card liability.

Tax: tip reporting, FICA credit where eligible, cost segregation for build‑outs, state/local compliance.

Win: weekly cash clarity, better food+labor targets (prime cost guardrails).

6) Administrative & Support / Waste Services (staffing, janitorial, facilities)

Pain points: tight spreads, receivable risk, compliance exposure.

CFO moves: client credit policy, payroll funding forecast, rate cards by skill/shift, DSO guardrails, insurance/cert tracking.

Accounting: timekeeping integration, payroll accruals, project profitability.

Tax: multi‑state withholding/situs issues, credits for training in some states.

Win: safer growth with cash‑positive terms.

7) Real Estate & Rental & Leasing (property managers, equipment rental)

Pain points: capex timing, debt covenants, seasonal utilization.

CFO moves: debt ladder, covenant early‑warning, utilization pricing, reserve policy.

Accounting: lease accounting (ASC 842 for GAAP adopters), security deposit tracking, capex capitalization.

Tax: cost segregation, 1031 mechanics (with counsel), passive/active grouping, bonus depreciation timetable.

Win: resilient cash coverage and compliance cleanliness.

8) Other Services (repair, personal services)

Pain points: owner‑centric operations, inconsistent pricing, cash‑basis blind spots.

CFO moves: price floors per hour/bay/chair, membership/maintenance plans, calendar density targets, simple KPI tree.

Accounting: daily sales integration, petty cash controls, prepaid/membership liability.

Tax: sales tax compliance (local), home‑rule nuances, entity choice for payroll tax optimization.

Win: steady owner’s earnings with less volatility.

9) Transportation & Warehousing (last‑mile, 3PL, freight brokers)

Pain points: fuel volatility, driver availability, asset financing, razor‑thin spread.

CFO moves: fuel surcharge policy, route profitability, fleet capex model vs leasing, safety KPI to lower insurance.

Accounting: mileage/fuel reconciliation, maintenance capitalization, brokerage trust accounting.

Tax: heavy vehicle depreciation, per‑diem rules, multi‑state apportionment.

Win: predictable cash and fewer surprise repairs derailing the month.

10) Manufacturing (light manufacturing & DTC ops)

Pain points: yield loss, long lead times, inventory cash drain.

CFO moves: standard costing and variance, MOQs vs cash, S&OP calendar, make‑vs‑buy, throughput accounting.

Accounting: BOM/routings accuracy, overhead absorption, WIP integrity.

Tax: Section 199A/QBI planning where applicable, R&D credit (process improvements), state incentives.

Win: stronger gross margin and faster cash cycle.

What changes when you add CleverProfits (your integrated finance partner)

- Fractional CFO Services: strategic planning, financial modeling, cash flow forecasting, board‑ready reporting, banking & fundraising prep.

- Accounting & Bookkeeping: accurate, on‑time close; AP/AR, payroll coordination, reconciliations, revenue recognition.

- Tax Planning & Filing: proactive credits/deductions, quarterly estimates, multi‑state, entity optimization; executed through Tax Planning and Tax Filing.

- One cadence: close in <10 business days → exec finance meeting → actions with owners → quarterly reset.

- Outcome: higher operating margin, safer cash, credible plan.

Cost & ROI (what to budget)

- Fractional CFO retainer: scope‑dependent, commonly $3k–$12k/month; outsourced CFO projects billed hourly for special events (raise/M&A) or early stage.

- Accounting & bookkeeping: packaged by complexity; automation keeps costs predictable.

- Tax: planning plus filing calendar (federal/state/locals, quarterly estimates).

- ROI often appears as: pricing resets, vendor/terms savings, tax credits, inventory/working‑capital improvements, reduced bad debt, and avoiding mis‑hires.

The CleverProfits 4‑Step System (How We Work Together)

Simple, repeatable, and built to show results fast.

Step 1: Provide — Provide access

Share logins to your accounting, tax, and finance tools—step one to organizing your finances.

What we collect: QuickBooks/Xero, payroll, banking/credit cards, AP/AR (Bill.com/Ramp), merchant processors, inventory/CRM, prior tax returns, cap tables, and loan docs.

Outcome (Week 0–2): Secure data access, roles & permissions set, kickoff complete.

Step 2: Prepare — Prepare the books

We clean, organize, and surface the numbers that matter.

What we do: normalize P&L (market‑rate owner pay), accrual close, COA cleanup, revenue recognition, AR/AP reconciliation, bank/CC reconciles, and a tax risk map (nexus, entity, estimates).

Outcome (Week 1–4): Accurate, on‑time close, clear cost buckets (COGS vs delivery labor vs overhead), and a baseline KPI snapshot.

Step 3: Plan — Build the operating model

We turn clean books into a plan you can run.

What we build: 18–24‑month financial model with scenarios, 13‑week cash flow, price floors/discount guardrails, hiring triggers, KPI tree, and a tax planning calendar (credits, elections, quarterly estimates).

Outcome (Week 3–6): Board‑ready forecast and a one‑page Owner’s Earnings / True Profit view.

Step 4: Profit — Profit with clarity

Execute the plan and build durable profit.

What happens: monthly close (<10 business days) → Exec Finance Review focused on True Profit (Owner’s Earnings) and a clear distribution policy; weekly cash huddle to protect runway; targeted margin sprints (pricing tests, leakage fixes, utilization gains); vendor‑terms & collections playbooks; ongoing tax filing & compliance so taxes never surprise cash; and a living decision log so actions compound quarter over quarter.

Guardrails: invest from surplus True Profit only, maintain runway thresholds, respect payback targets for ads/capex, and track 5–7 KPIs (GM, CM, OM, DSO, Utilization, Payback, Retention).

Outcome (Week 6+ and ongoing): predictable free cash flow, rising operating margin, faster decision velocity, and confidence to scale or distribute – with clarity.

Bonus: Every quarter we reset the plan to reality so you always know what’s safe to invest and what’s safe to distribute.

FAQ’s

Is a fractional CFO only for tech?

No. The model is built on cash, margin, and planning—universal mechanics across sectors.

Do we still need our CPA/bookkeeper?

Yes. We integrate with or provide both: Accounting & Bookkeeping and Tax Filing, so strategy turns into compliant numbers.

How fast do results show up?

Cash visibility and reporting cadence in weeks; margin and working‑capital gains over 1–3 quarters.

What if we operate in multiple states?

We design apportionment, sales/use tax, and payroll nexus workflows under Tax Planning.

Conclusion

If you want one partner to install the same finance discipline the best operators use – without hiring a $250k full‑time CFO – book a strategy call with a CleverProfits CFO. We’ll map your next 90 days and show where cash, margin, and tax savings are hiding in your industry.

The Clever Writing Team

The CleverProfits writing team includes various team members in Advisory, Financial Strategy, Tax, and Leadership. Our goal is to provide relevant and easy-to-understand financial content to help founders and business leaders reach their true potential.

TABLE OF CONTENTS

- 13‑week cash flow, board‑ready reporting, cash flow forecasting, CFO strategy Secondary: accounting and bookkeeping, contribution margin, DSO/DPO/CCC, financial modeling, fractional CFO services, outsourced CFO, pricing strategy, small business CFO, tax filing, Tax Planning, unit economics, utilization, working capital management