Are you struggling to grow your agency, coaching, or creator business? If so, you might be unfamiliar with how to use growth cycles to grow!

Do ANY of these statements resonate with you as you’re trying to grow your online business?

- “I have no idea how my business is performing.”

- “I don’t know why I can’t break through this revenue wall.”

- “My Stripe revenue is going up, but my bank account stays the same.”

If so, read on. I’m going to show you how understanding growth cycles can solve each of these problems.

Allow me to illustrate this with an example. Imagine this scenario in your 1-on-1 coaching program. You are:

- generating $30k/month in non-recurring revenue

- paying two contractors $10k/month

- paying yourself $8k/month

- running Facebook ads to your VSL $3k/month

- paying monthly SaaS subscriptions for $3k/month

- paying your office lease for $1.5k/month

You have no idea what you need to do to grow and scale to $100k/months and beyond.

Enter: Growth Cycles.

What Are Growth Cycles?

At any given moment, you should focus on either maximizing profit OR maximizing growth in your business. Why can’t you maximize both at the same time?

Profit requires efficiently using less resources to maximize your bottom line.

Growth requires investing more resources to maximize your top-line revenue.

Profit and growth are like oil and water. They are always in direct conflict with each other on opposite sides of the spectrum. If you try to do maximize both at the same time, you end up accomplishing neither.

A growth cycle is simply a commitment to work on either maximizing profit OR maximizing growth in your business over a fixed period of time.

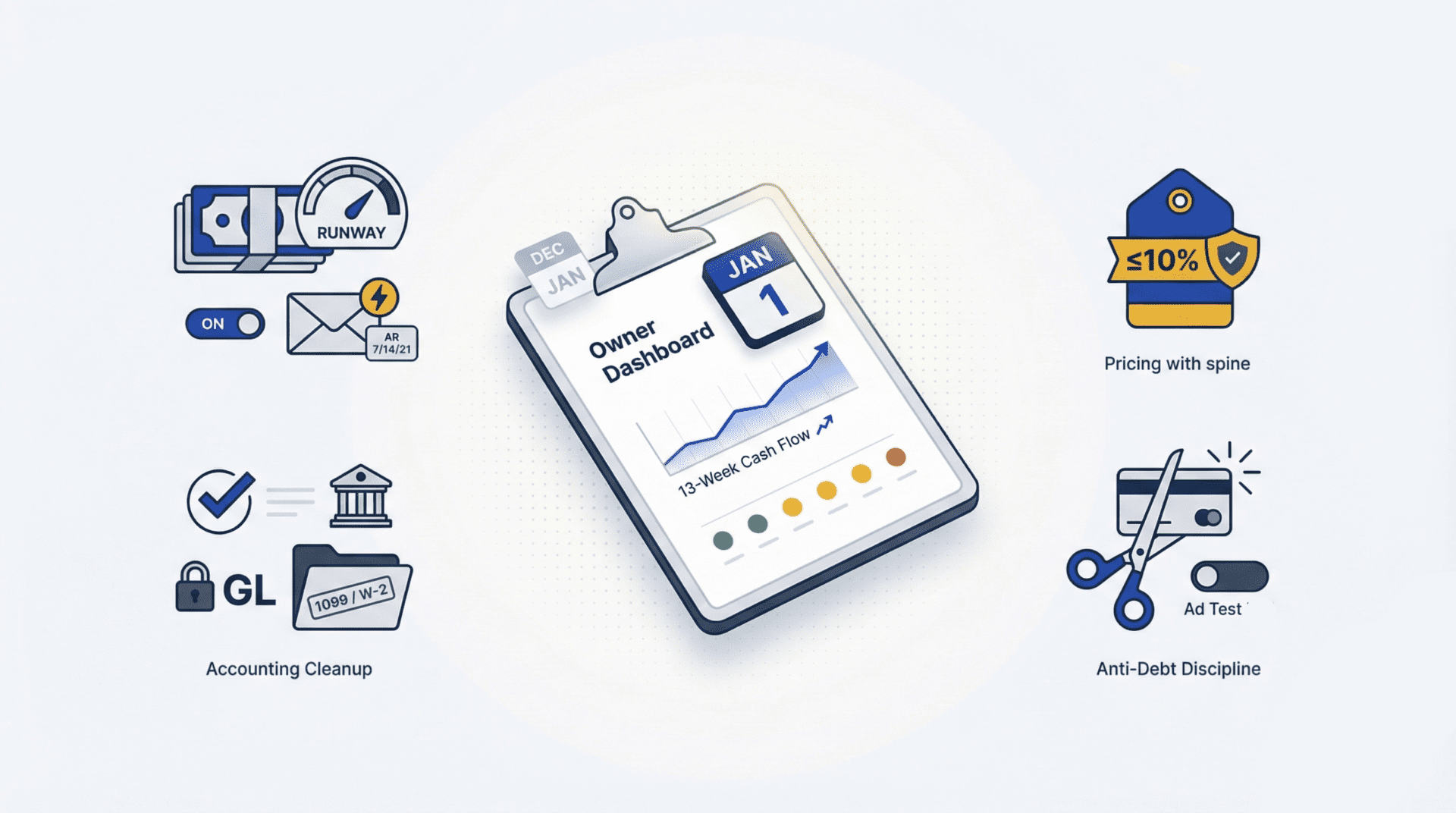

Labor and Advertising: Key Drivers in Your Business

Before you can understand your growth cycle, you must understand that there are only two key drivers in your business.

Labor, or what you pay to employ people in your business, is by far one of the largest drivers in your business – especially if you run an agency, coaching, or consulting company. You need people in sales, marketing, fulfillment, and operations to drive your business forward. People are your biggest asset.

Advertising, or what you pay to acquire clients, is the other major driver in your business – especially if you run a digital products or course company. This includes ad spend on platforms like Google, Facebook, and YouTube to drive traffic and generate sales. You need to spend on client acquisition for revenue – the lifeblood in your business. Without advertising, you’ll be the prized stallion who can’t make it out of the gate because you have no clients.

Your ability to make a profit from your business wholly depends on how efficiently your business spends on labor and advertising. It’s just simple math.

This doesn’t mean you should cut expenses just to become profitable. It just means that your business is only as good as your people and client acquisition ability, and this is where your attention should go as an entrepreneur.

The Perfect Formula: The Golden Ratio

Your online business model (like an agency, coaching, or digital products) dictates what the ideal combination of labor and advertising relative to revenue should be. Here are some quick benchmarks that we’ve built in our experience working with hundreds of clients:

- Done-for-you Agency: 50% Labor, 10% Advertising

- 1-on-1 Coaching: 40% Labor, 20% Advertising

- Group Coaching: 30% Labor, 30% Advertising

- Online Courses: 20% Labor, 40% Advertising

As long as the total combination of labor and advertising does not exceed 60% of revenue, that should give us enough of a cushion to work with our remaining overhead costs and still achieve a comfortable profit margin.

The Perfect P&L: Target for Maximum Efficiency

The Perfect P&L is a visualization tool we use with our clients to quickly identify what their ideal combination of labor, advertising, and overhead should be when their business is operating at maximum efficiency. In our example, we could construct the Perfect P&L for a 1-on-1 coaching business like so:

- Revenue: 100%

- Labor: <40%>

- Advertising: <20%>

- Overhead: <10%>

- Profit Margin: 30%

This is the Perfect P&L for a 1-on-1 coaching business when its operating at maximum efficiency. A 30% target profit margin allows us to build enough operating cash flow in our business before we transition to maximizing growth.

Maximizing growth will require us to invest more resources in advertising and labor. Therefore, we need to reserve enough cash on hand so we have enough money to work with during our growth period. The intent is to build a margin of safety in our cash reserves in case we need to course correct in the future – without going into debt and spiraling out of control.

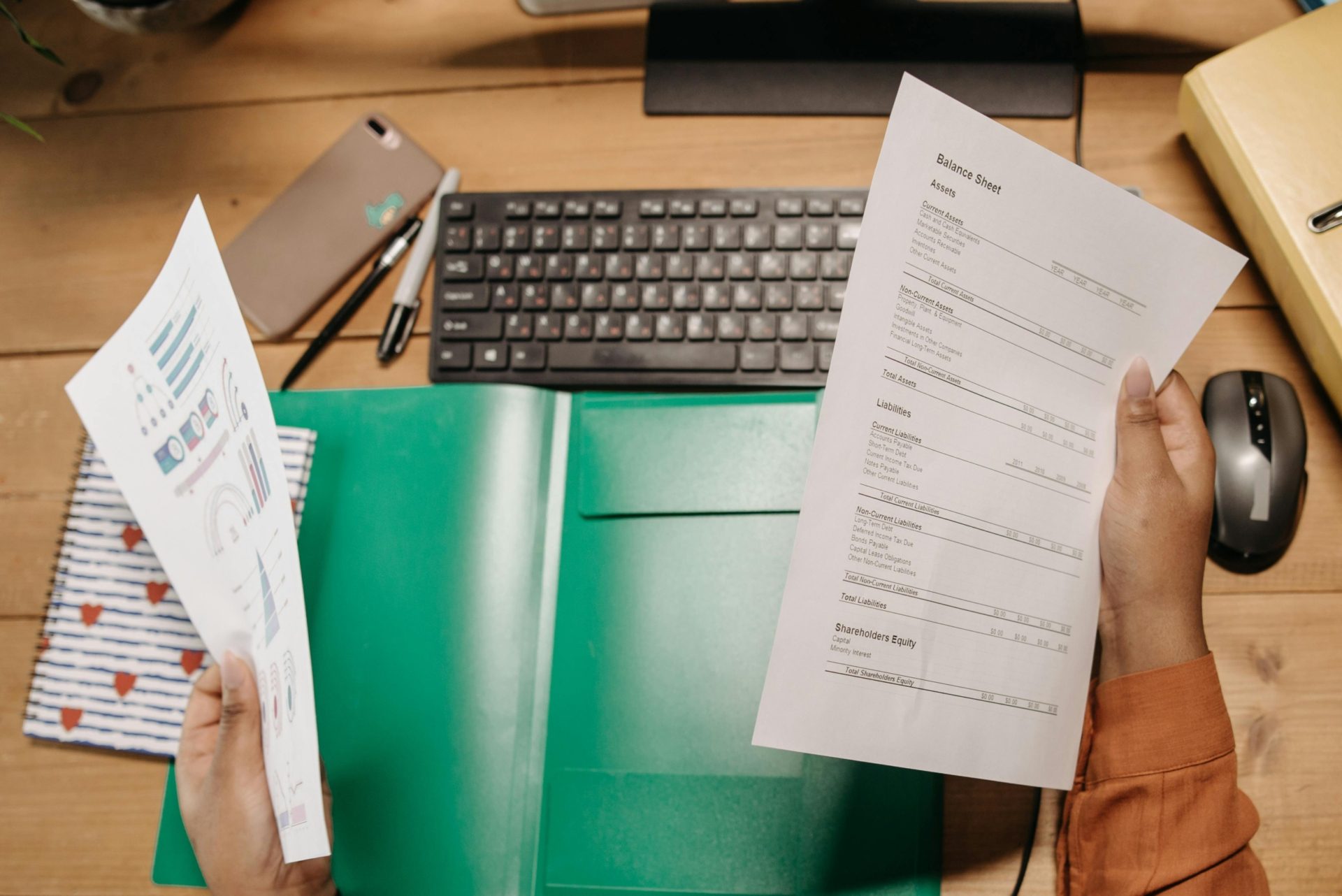

One BIG Problem: Measurement

The biggest reason that online entrepreneurs hit a growth wall is that they don’t have a measuring tool to see how their business is doing. They don’t have a yardstick that tells them what their profit is, OR they have a yardstick, but they don’t know how to use it. That’s where a great strategic advisor can help you. We can make sure you’re using your yardstick to its fullest potential.

You need an accounting system to track and measure your business operating results over a period of time, otherwise you have no way of knowing how well your business is doing. This is why our flagship Profit Accelerator program helps our clients set one up. Most of the time their yardstick isn’t properly configured for their specific type of online business (agency, coaching, or digital products.)

Why Your Labor Costs Are Skewed

One common example of not using your accounting system is measuring your labor costs. We run into a LOT of entrepreneurs who don’t take into account their own salary in their business’ income statement. If this is you, I have one thing to tell you: you need to factor in your own economic value in your labor costs, even if you don’t pay yourself. Otherwise, you are severely undervaluing your true labor costs and we can’t measure the quality of your business.

You have no idea how many peoples’ minds we’ve blown after we showed them how much their business was bleeding because they weren’t factoring in a fair salary for themselves or their spouse.

Construct Your Income Statement

Once we have a proper accounting system in place, we can create an income statement that measures the two key drivers using the details in our example above:

- Revenue: $30,000

- Labor: <$18,000>, 60% of Revenue

- Advertising: <$3,000>, 10% of Revenue

- Overhead: <$4,500>, 10% of Revenue

- Profit: $4,500, 15% Profit Margin

We can review this income statement and the key drivers of our business against the Golden Ratio and the Perfect P&L to diagnose any holes. It’s pretty clear that in this example, our labor costs are skewed by about 20% of revenue, or $6,000.

Analyze Your Operating Results

From here, we can observe the following compared to the Perfect P&L:

- Our labor costs are too high by about 20% of revenue, or $6,000.

- Our advertising spend is too low for our model by about 10% of revenue, or $3,000.

- Everything else falls within our KPIs.

It seems pretty clear what we need to do, right? Just cut a team member and pump ad spend? Not so fast.

Don’t Fall For The Classic Trap

The trap entrepreneurs many fall into at this stage is the incorrect assumption that they need to cut their labor costs in order to hit the acceptable range. Just because our labor-to-revenue ratio is 40%, and is $6,000 higher than the range, does NOT mean the problem is paying our team too much.

We don’t believe that running a business is about forcing numbers into a box (sorry Profit First fans.) There are MANY OTHER qualitative factors associated with this result we need to understand in more detail, such as:

- business model

- industry and competitors

- unique value proposition

- revenue growth over time

- consistency of results over time

- external economic pressures

For example, we run a boutique, online accounting firm. We genuinely believe in hiring the best people to provide the best service for our clients, so we are willing to pay a premium for our team members. That comes at the cost of paying more for labor and decreasing our profit margin.

If we cut our labor costs (through lower salaries or reducing headcount) then we will compromise the quality of our service. This directly contradicts our core mission which is to help entrepreneurs grow and scale their businesses beyond 7-figures. This is our DNA. We would reject the hypothesis that we need to cut our labor costs.

Instead, we accept that we are not going to be able to scale as effectively by pumping ad spend. We instead rely more heavily on organic marketing through inbound marketing, word of mouth, and referrals. This might make it slower to grow our top-line revenue, but it’s the price we are willing to pay to succeed in our mission.

This is why acting on a false positive could hamstring your business when you should be growing and lead you down the dark path of stagnation.

Focus On Your Growth Cycle

Once you determine what cycle you are in, it’s time to focus.

If you’re focused on maximizing profit, it’s time to focus on improving your operational efficiency through automation, training, and standard operating procedures. You’ll see huge productivity increases across the board while maintaining the same level of revenue.

If you’re focused on maximizing growth, it’s time to focus on getting clients in the door. Work on paid advertising methods, growing your sales team, and monitoring client fulfillment. You should see your profit margin dip (no less than 10%), but your top line will continue to grow.

Once you hit your growth ceiling, you can switch back to maximizing profit and efficiency at your new level of growth and work your way back up to a great profit margin – at your new level of revenue.

Throughout your business’ life, you will continue alternating between maximizing profit or maximizing growth – like a pendulum. By understanding the same strategies we use for our clients, you will always know what needs to be done at any time in your business.

Work with a Fractional CFO

Sometimes it’s hard to separate the forest from the trees especially if you are a biased participant being both the CEO and owner of your own business. Fortunately, you can hire a strategic advisor who knows all about your business model and can help pinpoint what you should be focusing on.

CleverProfits has helped over one hundred clients in the online business space grow and scale their businesses using this same process with our Profit Accelerator program. If you want to learn more about how we help our clients, check out our library of resources below.

The Clever Writing Team

The CleverProfits writing team includes various team members in Advisory, Financial Strategy, Tax, and Leadership. Our goal is to provide relevant and easy-to-understand financial content to help founders and business leaders reach their true potential.