Profit-sharing agreements are there to incentivize your key partners and protect your business by clearly defining who gets what, how much, and when. And a strong, clearly defined profit-sharing agreement will help align everyone you work with to the entirety of your business vision.

Before we dive into how to create a strong profit-sharing agreement for your business, let’s quickly brush up on what it is and which situations it works best in.

What is a profit-sharing agreement?

A strong and clearly defined profit-sharing agreement is best suited to a long-term vision for your business. As you grow and increase your reach as a business you will also depend on other people to support your work. These people can lead your sales team, development team, and other important departments that help your company function every day. The ideal situation to use a profit-sharing agreement is when the work a partner does impact the entire business. So you want to share your profits with someone who isn’t just limited to marketing or just to sales, but rather the business as a whole. The profit-sharing agreement is an incentive-based approach to growing your business towards a long-term goal, so you don’t want to incentivize a role that only has a high impact in one area.

Now that you understand the basics of what a profit-sharing agreement is and when best to use it, let’s dive into the five most important considerations when making one.

The five most important considerations when creating a ProfitSharing Agreement

1. Clarify expectations

Business is as much about strong relationships as it is about making money. The last thing you want when you’re focused on running a business is whether or not you agreed to something vague — especially about profits. That’s your company’s hard-earned money and you want to protect that from vague expectations. And when it’s time to enter into an agreement about sharing this profit, clarity about what expectations you have of the other person and what they can expect from you is the most valuable first step. Identify what counts as a salary, expenses, and the profit itself.

2. Define the role

Lay down the ground rules. You must define what roles you’re going to pay. Identify what it takes for a person to enter into a profit-sharing agreement: what are they responsible for? Which departments does their work affect directly? How much expertise and drive do they bring to the table? Do they understand and actively contribute to the company’s vision?

If you simply like working with someone and want to formally agree on sharing profits that means you have failed to define roles.

Here, it’s important to remember that just because someone in sales does a fantastic job it doesn’t mean they shouldn’t be rewarded with incentivized agreements. It’s better to offer them a commission-based sales agreement instead of a profit-sharing one. This will motivate them to continue producing excellent results.

3. Begin with a fixed-term agreement

The next consideration is a limited timeframe based on clearly defined roles and expectations. Now that you’ve defined who gets a share of the profits and how much based on what roles they play, it’s also worth including how long they get to keep getting a share of the profits. What our business looks like at the beginning, earning $250,000 a month, is not the same as a business that’s earning four times that a few years down the line. Limiting how long you can share profits is a protective measure because you can pause and reassess whether or not the other person is still directly — and positively — impacting the company’s growth.

Ask yourself whether the other person will be aligned with the company’s vision and mission six months or a year from now. And whether their role is impacting the entire company or just one department. The distinction is vital because a profit-sharing agreement works best when offering it to someone whose work affects the entire company.

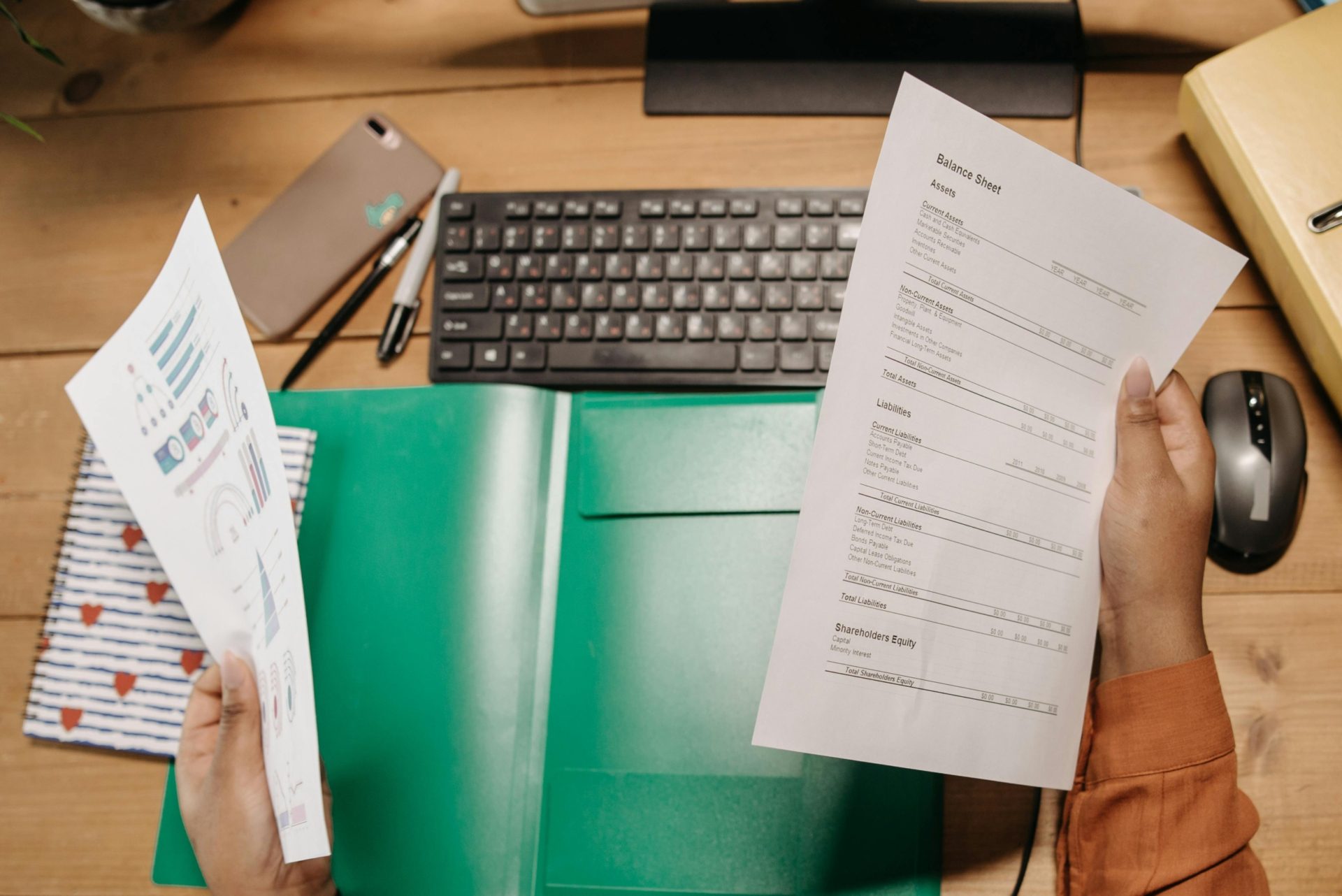

4. Calculate how much and when to share profits

A strong professional relationship grows from clearly defined roles and expectations. The last thing you want is to create unnecessary tension between you and your highly motivated, high-performing employee. Creating incentives and then diminishing their worth because you didn’t factor in taxes, salaries, and overhead costs will harm your business and damage your relationships. So when the time comes for you to work out how to share the profits you’ll need to consider a few key things:

- What counts as tax-deductible expenses (like travel, meals, and accommodation) and as personal expenditures (like loan repayments, insurance, and entertainment)?

- What is the cap on profit-sharing based on salaries and taxes?

- How do you calculate the share of the profits against that person’s own salary?

Always remember, profits come in at the end of the process. Make sure you’re setting the business up for success as much as you’re incentivizing the other person to stay motivated.

5. Agree on what happens when the business has losses

Everyone thinks the business will always be profitable, but what happens when there are losses? Difficult times can strain relationships and demotivate even the best-performing staff, so it’s important to consider whether your profit-sharing agreement will also include sharing the loss.

Imagine you sell $100,000 worth of a product but client acquisition performance and overheads amounted to 150,000. You are now negative 50k. Does your profit-sharing agreement stipulate that the person that you’re sharing the profits with also shares the loss? Are they now 50-50 on the loss too? Are they subject to the $25,000 loss that they need to compensate the business?

While it seems only fair that the other person bears the burden of losses, it can only be expected if you write it into the agreement.

Now that you know the top five things to consider when making a profit-sharing agreement, we’ve got two final bits of advice for you: go slow, and trust your gut.

Businesses don’t just become successful with only a few bold, quick decisions. They require a cautious and thoughtful decisiveness every day. You need to feel confident about the person with whom you are entering into an agreement. A profit-sharing agreement is way beyond the 1099 or the W-2, or even an incentive structure. This kind of agreement is a step away from bringing them in as an equity partner, so it’s important to ask yourself whether they fit the company vision and whether they are in it for just the money or also for the post-losses rebuilding. As a business owner, you must be confident in your decision, and that comes from recalling pitfalls and recognizing the potential in ways that grow the business steadily and sustainably.

Confused about Profit-sharing agreements and need help?

Still not feeling confident about this kind of agreement? Don’t worry, CleverProfits is here to guide you through the process. Schedule a consultation with an advisor today!

The Clever Writing Team

The CleverProfits writing team includes various team members in Advisory, Financial Strategy, Tax, and Leadership. Our goal is to provide relevant and easy-to-understand financial content to help founders and business leaders reach their true potential.