Fractional Finance Department: What It Is + When You Need One

If your financial “system” is a mix of QuickBooks, a spreadsheet, and vibes: you’re not alone. The issue isn’t that you’re doing anything wrong. It’s that your business grew up…and your finance function didn’t. If your numbers are late, cash feels unpredictable, or taxes are always a surprise, a fractional finance department gives you a […]

Why YOU Need a CFO: A Satirical (But Serious) Guide for Business Owners

TL;DR (For the Busy, Brilliant, and Mildly Caffeinated) Let’s Be Honest: Are You Asking a Plumber to Fly a Fighter Jet? Imagine this: your sink is leaking, so you call your favorite plumber. They arrive with a toolbox, diagnose the drip, and fix it. Stellar. Now imagine strapping that same plumber into an F-16 and […]

Why a Fractional CFO Works for Any Industry: The Top 10 SME Sectors (and How CleverProfits Helps Each One)

TLDR: A fractional CFO gives you enterprise‑grade financial strategy, pricing, forecasting, cash discipline, and board‑ready reporting – without the full‑time price tag. It works in any industry because the CFO playbook maps to your revenue engine, unit economics, and cash cycle. CleverProfits wraps this with airtight accounting and proactive tax planning & filing so you […]

Why Hire a Fractional CFO in 2025? The Most‑Asked Questions – Answered (and How CleverProfits Helps)

Quick Answer – for Busy Humans Why hire a Fractional CFO? Because you get enterprise‑grade financial leadership – cash flow control, pricing strategy, forecasting, board‑ready reporting, and tax efficiency – at a fraction of a full‑time cost. A Fractional CFO helps you grow, protect margin, and scale with discipline while your accounting team keeps the […]

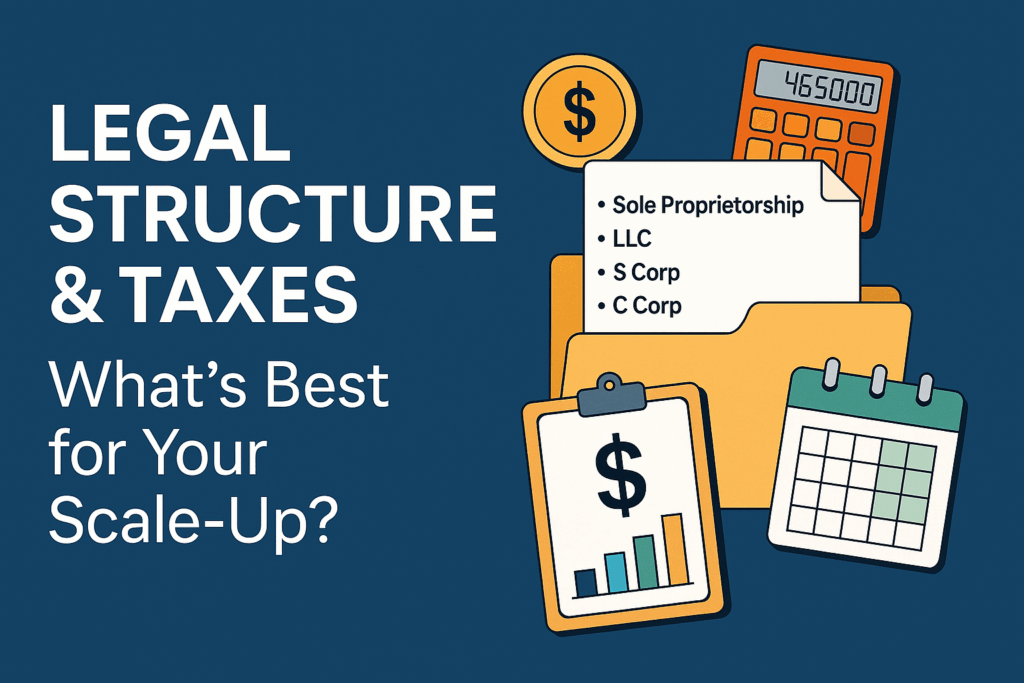

Legal Structure & Taxes: What’s Best for Your Scale-Up?

Making the right legal entity choice for my business Choosing the right legal entity is one of the highest-impact decisions a founder makes after achieving product-market fit. The structure you lock in today steers tomorrow’s tax bill, fundraising options, liability exposure and administrative overhead. This guide walks scale-ups through the four most common entities: sole […]

Ultimate Year-End Tax Planning Guide for Small Businesses

Don’t let last-minute tax math give you a fright. This guide walks you through every critical step for closing out your fiscal year with confidence and clarity. You’ll learn how to optimize year-end taxes, gather documents, and leverage professional tax planning services so your business keeps more of its hard-earned revenue. Why Year-End Tax Planning […]