Every entrepreneur needs to understand basic accounting in order to responsibly grow their business. Without understanding basic accounting and what the numbers are telling you, it’s impossible to answer simple questions like:

- How much should I pay myself?

- Can I hire another contractor?

- Are my client projects profitable?

- Do I have enough working capital to pay my workforce? My vendors?

- How much should I set aside for taxes?

This guide is a crash course for any entrepreneur who wants to learn how to construct their numbers using basic accounting. It’s an unconventional approach that I use to quickly educate business owners in 5 minutes or less. It’s great because you don’t need a 4-year accounting degree to learn how to read the numbers!

Imagine every transaction that happens in your business:

- Clients paying you

- Buying new computer hardware

- Paying your contractors

All of these transactions have to be recorded and tracked in your books so you know how much you made during the year and how much you have left.

We use accounting – a system of logic used to aggregate and report all of your company’s transactions. We use a double entry system in order to see changes to your company’s worth, which means that every transaction has an equal and opposite effect in two different places. More on this later.

With accounting, you can build the core financial statements that will help you understand the numbers as a business owner:

- Balance sheet

- Income statement

- Cash flow statement

- Equity statement

In this article, I’m going to focus on the first two statements – the Balance Sheet and Income Statement. I’m also going to explain the relationship between the two financial statements and how to apply the language of accounting.

Accounting – Balance Sheet

A balance sheet is a snapshot of your company’s assets, liabilities, and equity at a specific point in time. It measures your financial position based on what you own, what you owe, and what you’re worth.

The fundamental accounting equation for any balance sheet is:

Assets – Liabilities = Equity

Let’s go through the components of the fundamental equation.

An asset is something that you own. It’s a benefit for your company in the future. Common examples of assets in a business are:

- Cash in checking account

- Accounts receivable

- Computer equipment

- Deposits

- Prepaid expenses

A liability is something that you owe. Your company will have to give up something it owns in the future. Examples of liabilities in an business are:

- Accounts payable (bills you have to pay)

- Credit card liabilities

- Accrued liabilities

- Client deposits

- Loans to be repaid

Equity is your total assets minus your total liabilities. It’s what you own minus what you owe. It represents what your company is worth… on paper, at least.

To reiterate, the fundamental accounting equation for any balance sheet is:

Assets – Liabilities = Equity

or, said in an easier way:

What you own – What you owe = What you’re worth

A simple example to understand the balance sheet is through home ownership. Imagine you bought a $1,000,000 home. You made a 20% down payment, or $200,000. You financed the rest of your home purchase by borrowing $800,000 from your bank.

Your home is an asset worth $1,000,000 that you bought using $200,000 of your own money and $800,000 of the bank’s money.

Represented in the accounting equation:

Accounting – Income Statement

The income statement measures the change in equity from one point in time to another point in time. The income statement breaks down the total change in what you’re worth into categories that help explain what you’re earning and what you’re spending.

Your income statement is made up of two primary categories: revenue and expenses.

Revenue represents money flowing into your company. It originates from how your business makes money. The offsetting side of a revenue entry is typically to an increase in Cash or Accounts Receivable depending on how you get paid.

Some examples of revenue inflows are:

- Recurring revenue

- Content production

- Maintenance

- Variable (pay per x)

- Non-recurring revenue

- SEO consulting

- Website design/development

Expenses represent money flowing out of your company. The offsetting side of an expense entry could be a reduction to Cash or an increase to Accounts Payable, Credit Card Liability, or other liabilities.

Some examples of expense outflows are:

- Labor

- Marketing and advertising

- Rent/facilities

- Software

- Taxes

To frame this in the fundamental accounting equation:

Assets – Liabilities = Equity

If your assets go up, your equity goes up. If your liabilities go up, your equity goes down. Changes in equity are mostly reflected through your income statement.

Accounting Relationship Between Balance Sheet and Income Statement

Let’s stop here for a moment. If you’ve followed this far, then you can see that there is a very visible relationship between the balance sheet and income statement. The income statement really just measures the change between the balance sheet at two different periods.

Another way of understanding this is that every time an asset or liability changes in your balance sheet, there’s probably going to be a change – either in your equity or somewhere else in your assets and liabilities. The key is knowing what transactions affect your income statement.

Example 1: Invoicing a Client

Let’s say you invoice your client $5,000 for their monthly retainer on January 1, 2019.

Your Accounts Receivable balance would go up $5,000. The business is now worth $5,000 more because it’s entitled to future payment from your client – even if you haven’t received the cash yet.

The other side of the transaction goes to revenue in your income statement because it increases what you’re worth.

Example 2: Client Pays Your Invoice

Your client pays your $5,000 invoice on January 31.

Cash balance goes up by $5,000 because that payment now sits in your company’s bank account – free and clear.

Accounts Receivable balance goes down by $5,000 because your client paid the invoice.

There’s no change to equity or the income statement because your total assets and liabilities didn’t change.

Example 3: Paying for Facebook Ads

Let’s say you were billed $1,000 for Facebook Ads for a marketing campaign to attract clients.

Credit Card Payable goes up because you now owe $1,000 on your credit card.

The business is now worth $1,000 less because it owes money to your credit card company in the future – even if you haven’t paid it yet.

The other side of the transaction goes to an expense in your income statement because it reduces what you’re worth.

Example 4: Pay Your Credit Card Bill

You pay your $1,000 credit card bill within the grace period.

Cash balance goes down by $1,000 because you just paid off your bill from funds in your checking account.

Credit Card Payable balance goes down by $1,000 because you paid your bill.

There’s no change to equity or the income statement because your total assets and liabilities didn’t change.

These four examples illustrate the relationship between the balance sheet and the income statement. Now we’re going to learn about the formal language of accounting and how we can quickly apply it to our examples above.

Formal Language of Accounting – Debits and Credits

Since accounting is a system of logic driven by the fundamental accounting equation, we use specific terminology to show that a change to one account must change another. This is referred to as “double entry” accounting.

If we look at the fundamental accounting equation:

Assets – Liabilities = Equity

Using simple algebra, we can move liabilities to the “right” side of the equation and maintain equality:

Assets = Liability + Equity

And from here, we can install our “language” of Debits and Credits:

In the language of accounting, a Debit must have an equal and opposite Credit.

- Assets are “increased” with a debit and “decreased” with a credit.

- Liabilities and Equity are the opposite – “increased” with a credit and decreased with a debit.

Since Revenue and Expenses are merely changes in equity:

- Revenue is “increased” with a credit and “decreased” with a debit.

- Expenses are the opposite – “increased” with a debit and “decreased” with a credit.

This system of Debits and Credits is a simplified way to represent transactions within the fundamental accounting equation. Every transaction is reflected in a Journal Entry.

Journal Entries dictate how the Debits and Credits are applied every account.

When looking at raw numbers, Debits are represented as positive and Credits are represented as negative. The sum total of every Journal Entry must balance to zero.

Let’s go through our four examples again, but this time, by creating a Journal Entry that applies the formal accounting language of Debits and Credits

Example 1: Invoicing a Client

Let’s say you invoice your client $5,000 for their monthly retainer on January 1, 2019.

Accounts Receivable balance increases by $5,000, so you would Debit Accounts Receivable by $5,000.

The opposite side goes against Revenue, so you would Credit Revenue by $5,000.

Example 2: Client Pays Your Invoice

Your client pays your $5,000 on January 31 – just in time.

Cash balance goes up by $5,000 because that payment now sits in your company’s bank account – free and clear. So you Debit Cash by $5,000.

Accounts Receivable balance goes down by $5,000 because your client paid the invoice. So you Credit Accounts Receivable by $5,000.

Example 3: Paying for Facebook Ads

Let’s say you were billed $1,000 for Facebook Ads for a marketing campaign to attract clients.

Credit Card Payable goes up because you now owe $1,000 on your credit card. So you Credit Payables by $1,000.

The opposite side goes against Expenses, so you would Debit Expense by $1,000.

Example 4: Pay Your Credit Card Bill

You pay your $1,000 credit card bill within the grace period.

Your Cash balance goes down by $1,000 because you just paid off your bill from funds in your checking account. So you Credit Cash by $1,000.

Your Credit Card Payable balance goes down by $1,000 because you paid your bill. So you Debit Payables by $1,000.

Accounting Summary

There you have it – a basic understanding of accounting for marketing entrepreneurs. These basic tools help you understand the relationship between the items on your balance sheet and your income statement. With a basic understanding of the language of accounting – Debits and Credits, you’ll know how to everyday transactions affect the numbers in your business.

Accounting is a system of logic to aggregate your company’s transactions in a meaningful way that allows you to understand the past. Even though numbers are rooted in the past, you can use historical records to predict how your business will grow in the future.

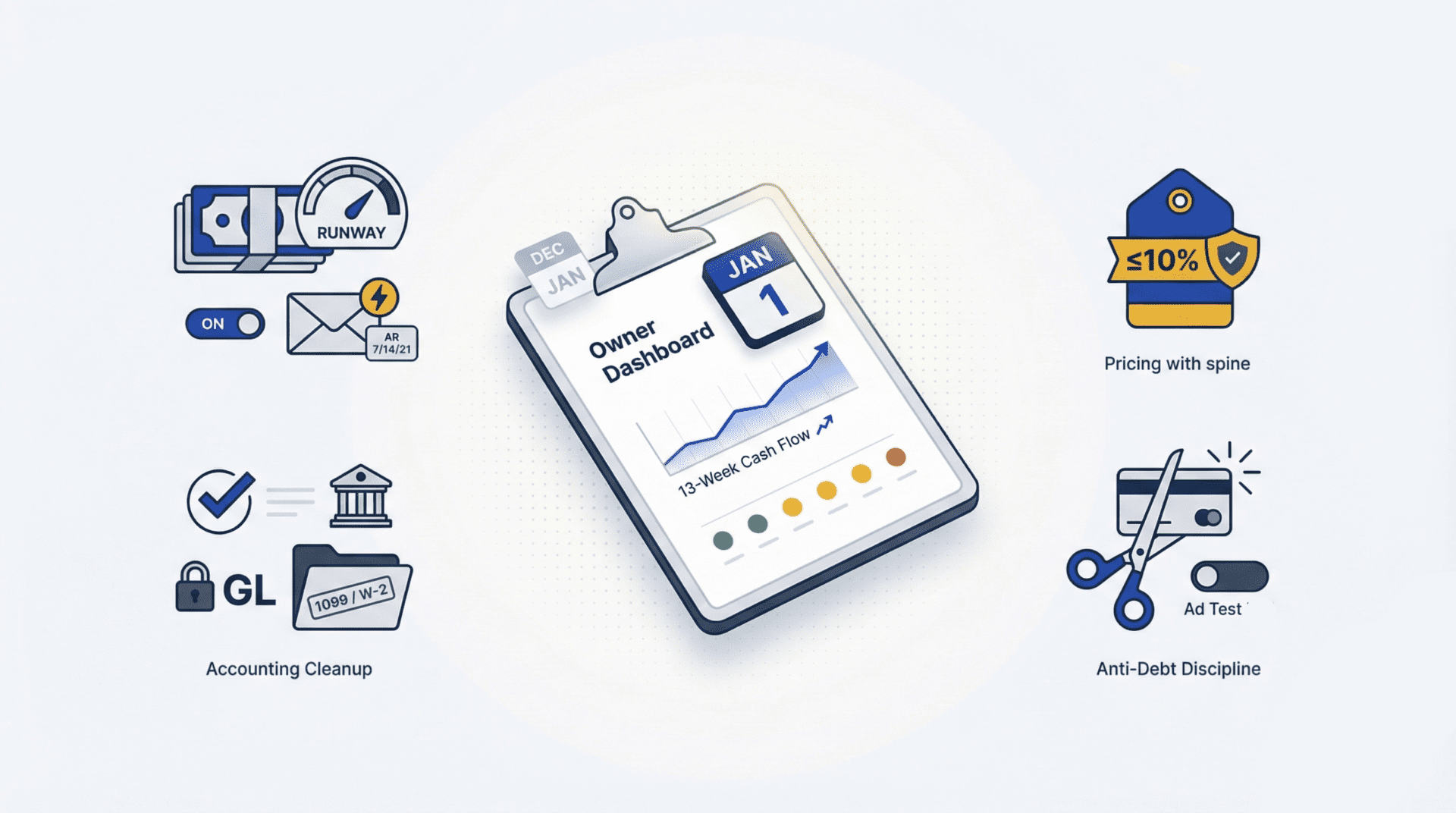

Digital entrepreneurs can use financial results to forecast their businesses’ growth to make critical business decisions. This means that having a good finance partner is really important for any entrepreneur looking to expand. Unfortunately, most online businesses aren’t large enough to warrant hiring a full-time resource to manage the finance function.

If you want to learn more about partnering with a number cruncher, I help digital entrepreneurs like marketers, coaches, and consultants gain control of taxes and finances in their online businesses. It starts with getting the accounting data right, and then harnessing the data to make important growth decisions for your business.

If you need help with taxes or finance, feel free to reach out for a 15-minute intro chat to see how I can help your business grow to new heights.

The Clever Writing Team

The CleverProfits writing team includes various team members in Advisory, Financial Strategy, Tax, and Leadership. Our goal is to provide relevant and easy-to-understand financial content to help founders and business leaders reach their true potential.